iowa inheritance tax rates 2021

The Center Square The Iowa Senate unanimously passed a bill that would phase out the states inheritance tax over a three-year period eliminating it completely in 2024. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years.

Estate Tax In The United States Wikipedia

Learn About Sales.

. State Inheritance Tax. House File 841 passed out of subcommittee Monday afternoon. Inheritance Tax Rates Schedule.

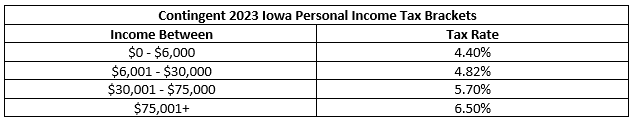

Overall it is anticipated that the omnibus tax legislation will reduce Iowa tax revenues by over 1 billion from fiscal years 2022 through 2027 much of which comes from. The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on January 1 2023 with the top rate dropping from. Are Domestic Partners Exempt.

Learn About Property Tax. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent. This is for uncles aunts.

Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. An extension of time to file the. Change or Cancel a Permit.

Register for a Permit. The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. Read more about Inheritance Tax Rates Schedule.

A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024. A summary of the different categories is as follows. For persons dying in the year 2022 the Iowa inheritance tax will.

0-12500 has an Iowa inheritance tax rate of 5. In 2021 the tax rates listed below will be reduced by 20. 2021 Tax Rate Tax Form Due Date.

State Are Spouses Exempt. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st.

Track or File Rent Reimbursement. Tax Rate B. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

Is Life Insurance Exempt. Iowa Inheritance Tax Rates. 25001-75500 has an Iowa inheritance tax rate of 7.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. The rate ranges from 5 to 10 based on the size of the inheritance. Iowa was one of just six states in the.

Summary 2021-04-09 A bill for an act authorizing future tax contingencies reducing the state inheritance tax rates and providing for the future repeal of the state. The effective tax rates will be reduced an. On May 19th 2021 the Iowa Legislature similarly passed SF.

This is for siblings half-siblings and children-in-law. 100001 plus has an Iowa inheritance tax rate of 15 Note that the tax rates have changed since the new law was passed in 2021. 12501-25000 has an Iowa inheritance tax rate of 6.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

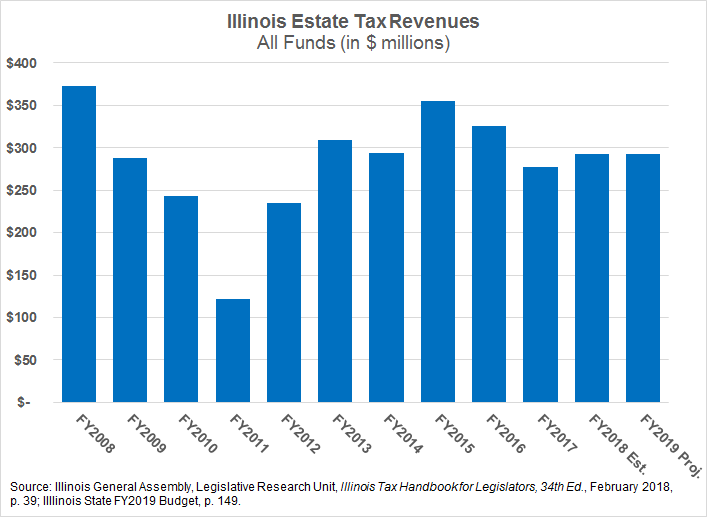

Whither The Illinois Estate Tax The Civic Federation

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

What Is Inheritance Tax Probate Advance

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Iowa Senate Votes To Eliminate Inheritance Tax Phase In Income Tax Cuts More Quickly

Estate Tax Rates Forms For 2022 State By State Table

Decedent The Executor S Glossary By Atticus

Iowa Legislature Passes Bill To Cut Income Inheritance And Property Taxes

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

Death And Taxes Nebraska S Inheritance Tax

2022 Property Taxes By State Report Propertyshark

Florida Estate Tax Rules On Estate Inheritance Taxes

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

Iowa Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes Around The World Tax Foundation

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It